I’ve written about the low housing inventory phenomenon many times over the course of a decade. I’ve also written about low inventory home buyer strategies in the past. Yes, this has been an issue for that long, although it has ebbed and surged. One consequence has been that many potential homebuyers have stayed away from the market, waiting for conditions to improve.

Low inventory home buyer strategies

Housing market conditions have left many homebuyers frustrated over the last few years. The outlook isn’t that much better this year. Housing inventory shortages will likely continue to hold buyer activity in check.

Although it is expected that many more homes will be sold this year compared to last, the pent up buyer demand will impact the average number of homes on the market at any given time. In plain language, on the current trajectory homes will continue to sell quickly and at appreciating prices.

Are you one of those still waiting for the housing market conditions to tip in favor homebuyers? Or are you just entering the market? Regardless, low inventory home buyer strategies, such as being prepared and proactive, will help you on your home buying journey.

If you’re paying cash for the home, make sure you have access to your funds (or prepared to get access) prior to entering into a contract. Having assets doesn’t necessarily mean it’s liquid or easily accessed. Ask for the process to get your funds from the institution holding your assets.

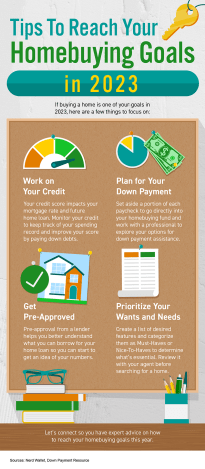

If you’re getting a mortgage, get preapproved. Having a preapproval will not only help you create a buying budget, it will give you a head start on the buying process. The preapproval letter attached to your offer tells the home seller the bank will give you loan based on the information they reviewed.

If you’re planning on working with a real estate agent, choose your agent before you start visiting open houses. Not knowing if and with whom you’re working can create an unnecessary delay on making an offer. Delays can put you out of the running if there is a tight deadline for offers.

That said, be prepared to make an offer quickly. Communicate to your agent your offer in price and terms. Most likely, the agent can quickly send the offer to the listing agent by having you electronically sign it.

It’s likely that your first (or subsequent) offer won’t be accepted, especially in a multiple offer situation. Always have a plan B, C, and D, which may include looking for off-market homes for sale, and the possibility of renting.

By Dan Krell

Copyright © 2024

Disclaimer. This article is not intended to provide nor should it be relied upon for legal and financial advice. Readers should not rely solely on the information contained herein, as it does not purport to be comprehensive or render specific advice. Readers should consult with an attorney regarding local real estate laws and customs as they vary by state and jurisdiction. Using this article without permission is a violation of copyright laws.